MoneyHash raises $4.5M for its payment orchestration platform serving merchants in MENA

The payment landscape in the Middle East and Africa (MEA) region is marked by significant fragmentation, with numerous payment providers and methods in each country, evolving regulations and diverse customer preferences. This complexity is further compounded by challenges such as payment fraud, low checkout conversion rates and high transaction failure rates.

Although the COVID-19 pandemic accelerated the adoption of digital payments in the region, infrastructure development remains inadequate. Payment failure rates are three times higher in the MEA region than the global average, and fraud rates and cart abandonment exceed those of other regions by more than 20%. This presents a challenge for merchants, who often perceive payments as a cost and risk center rather than a strategic enabler.

Payment orchestration platforms streamline payment processes for merchants through unified payment APIs. Egyptian fintech MoneyHash, one of such in Africa and the Middle East, has raised $4.5 million in seed investment, money it plans to use to further invest in its technology and growth across the region. This comes two years after the startup secured $3.5 million in pre-seed.

Nader Abdelrazik, co-founder and CEO of MoneyHash, highlights that 10% of all payments processed in the MEA region are digital, placing MoneyHash uniquely for a growth phase that the region will inevitably experience over the next decade. However, navigating this burgeoning payments market will demand patience and a commitment to continuous learning.

As merchants or companies launch their platforms, they often start by collaborating with one or two payment processing providers. As their operations grow and expand into multiple regions, they onboard additional payment providers to meet their evolving needs. However, integrating different payment stacks presents significant challenges. Besides the operational inefficiencies and technical complexities, in-house tech teams may take several weeks to complete these integrations. In Africa and the Middle East, these challenges are amplified by variations in payment methods, currencies and the isolation between countries.

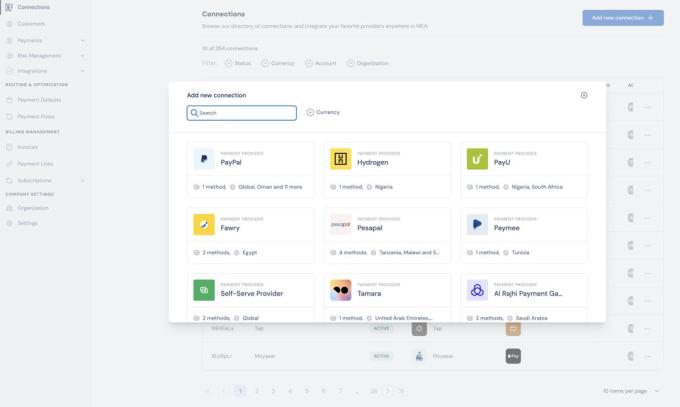

MoneyHash’s product includes a unified API to integrate pay-in and pay-out rails, a fully customizable checkout experience, transaction routing capabilities with fraud and failure rate optimizers and a centralized transaction reporting hub. This is complemented by tools enabling various use cases such as virtual wallets, subscription management and payment links. Fintechs such as Revio, Stitch, Credrails and Recital are similar players in the payment orchestration space.

In an email interview with TechCrunch, Abdelrazik shared insights into MoneyHash’s collaboration with merchants over the last four years. For one, he claims that payment failure rates across the region vary significantly, and relying solely on averages can be misleading. While the typical figures are around three out of 10 payments failing on average, the reality differs widely among businesses, he said. For some, it may be as low as one out of 10, while for others, it could be as high as five or six out of 10. Additionally, these figures do not include customers who abandon the checkout process voluntarily before making a payment. The CEO also noted that most of its customers don’t know much about the complexity of payments and, many times, are not aware that most leakages they have in payments are fixable.

MoneyHash gets $3M to build a super-API for payment operations in Africa, Mideast

Furthermore, merchants are expanding much faster than their partner payment service providers (PSPs). These PSPs operate under stringent regulations, making the rollout of new products and customizations slower than the merchants’ growth trajectory. As a result, MoneyHash has intensified its collaboration with PSPs, particularly those catering to enterprises and prioritizing customer requirements.

“Businesses appreciate the large network of integration we have not just for coverage but for expertise. When they know that we executed all these integrations in-house, they appreciate the team’s expertise and depth of knowledge and leverage our team to navigate difficult questions in payments. They know that working with us makes them future-proof,” noted Abdelrazik, who founded MoneyHash with Mustafa Eid.

“That means team expertise is key for us. Most of the time, we hire exclusively with payments and/or tech backgrounds, even in non-technical positions. We saw massive effectiveness in building a team where customers trust their knowledge and expertise in something specialized and critical like payments.”

Following a beta launch in 2022, which garnered the participation of key regional players like Foodics, Rain and Tamatem, MoneyHash introduced its enterprise suite last October, targeting large enterprises. Over the past year, the fintech, which integrates with various payment gateways and processors, including Checkout, Stripe, Ayden, Amazon Pay, Tap and ValU, claimed to have expanded its network of integrations, tripled its revenue and increased its processing volume by 3,000%.

At present, MoneyHash boasts 50 active paying customers. It does not offer free tiers; most customers accessing its sandbox without payment are potential clients in the assessment stage, numbering over 100. The payment orchestration platform levies a combination of SaaS and transaction fees, commencing at $500 + 0.4%. SaaS fees increase while transaction fees decrease significantly for large enterprises due to volume, Abdelrazik explained.

MoneyHash’s seed round was co-led by COTU Ventures and Sukna Ventures, with participation from RZM Investment, Dubai Future District Fund, VentureFriends, Tom Preston-Werner (GitHub’s founder and early Stripe investor) and a group of strategic investors and operators.

Speaking on the investment, Amir Farha, general partner at COTU, said his firm believes that the full potential of digital payments in MEA is yet to be realized and MoneyHash’s platform can catalyze the growth of digital payments across the region, enabling both global and local merchants to tap into new revenue streams. “We are thrilled to renew our support to a team that has consistently demonstrated superior execution, not just in securing top mid-market and enterprise customers, but also in expanding value across the entire chain, even under challenging market conditions,” he added.

COTU Ventures launches $54M fund for pre-seed and seed startups in MENA