Grifin’s new model can automatically invest your money as you shop

Investing app Grifin today officially launched its anticipated investing model called “Adaptive Investing,” which enables you to automatically invest in your favorite brands that you frequently shop from.

Grifin was founded in 2017 with the hope of making investing less intimidating and normalizing it for people who aren’t that financially savvy. To date, Grifin has raised more than $11 million from a notable list of investors, including TTV Capital, Rise of the Rest, Gaingels, NevCaut Ventures, Mana Ventures, Sidecut Ventures, Miami Angels and Playtap Media Ventures, along with Witz Ventures co-founder Austin Hankwitz and GGV Capital managing partner Hans Tung. The company says it sees about 20,000 unique new app installs per month.

Grifin’s new patent-pending technology is an evolution of its original model, which follows the premise of “Stock Where You Shop,” giving you a chance to explore the intimidating world of investing by aligning your shopping habits with stock choices.

“Investing, and even having a healthy positive relationship with money, is an incredibly difficult thing to do and achieve,” co-founder Aaron Froug tells TechCrunch. “The current system simply isn’t geared towards the individual, even with mobile access and 0% commission apps claiming to ‘open up’ investing to all. It still requires a lot of emotional energy, confidence and an understanding of how investing works. Most people still don’t feel like they have enough money to get started and even the most financially adept people I know don’t know what is inside most ETFs [exchange traded funds]. All of it is cloudy and complicated. None of it is centered around the individual.”

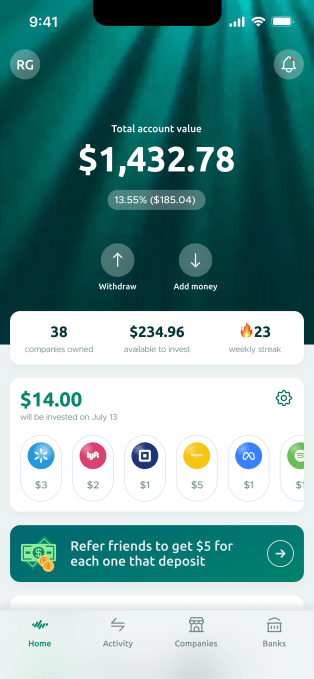

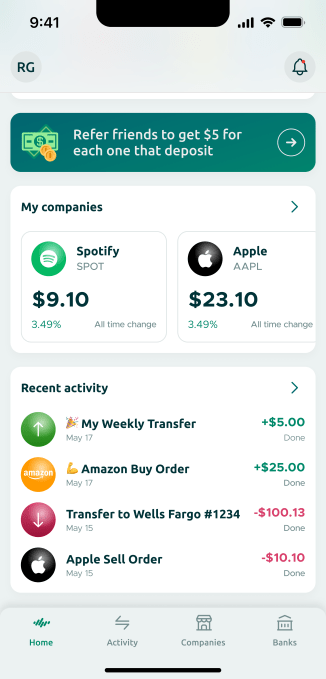

The Adaptive Investing model aims to give users more flexibility by integrating new functionality into the app, including the ability to pause automatic payments, increase/decrease how much you want to spend and manually invest more money in a company. It also introduces a “Secret Cash” function, allowing for non-public purchases and putting more money away as cash for their future.

“This patent-pending technology builds on the original premise by integrating new functionality to allow for a more intuitive and adaptive approach to investing, centered not just around people’s daily spending habits, but how much they want to invest,” Froug adds.

By default, Grifin automatically invests $1 per transaction. For instance, when you buy a cup of coffee at Starbucks, the app withdraws $1 from your bank account, and you get $1 of SBUX stock. You can also manually increase the investment amount to a maximum of $99.

However, just because you enjoy a certain brand, it doesn’t necessarily mean it’s a smart investment. Grifin now added a new “Disable Company” feature, allowing you to stop or avoid investing in certain companies. There’s also an option to pause your investments for a week.

“We are also keenly aware that just because a person spends at a specific place, they might not want to invest there… By investing in small amounts, as low as $1 at a time, the aim is to help people to learn to navigate the world of investing without incurring too many negative consequences if they don’t get it right,” Froug says.

Plus, Froug argues that Adaptive Investing reduces the impact of single-stock exposure since it encourages a diverse profile as consumers usually spend money across a wide range of companies — phone/internet bills, gas, monthly subscription services and so forth.

“I’ve been personally using our app for a little over two years and I’ve invested in 115 unique companies,” he notes.

Additionally, Grifin is planning a redesign of its app, which will include a premium version as well as an AI chatbot to help people learn how to invest.